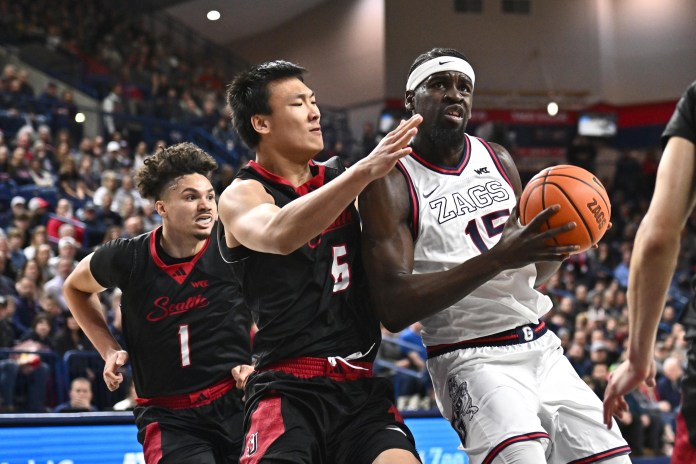

College Basketball Best Bets & Picks

Your Ultimate Resource for College Basketball Best Bets, News and Tips

At VSiN, we are dedicated to keeping college basketball fans informed with our comprehensive coverage of college basketball odds, news, and articles. From today's matchups to Vegas odds, betting splits, March Madness, and our CBB Betting podcast, we provide the resources you need to make the best NCAA basketball picks. Whether you're a die-hard fan or a sharp bettor, VSiN has got you covered. Stay on top of the action with up-to-date college basketball lines and odds, NCAA predictions, and more. Check out the links above or get right to the latest college basketball news below!

College Basketball News

Pro College Basketball Picks Today: Greg Peterson Best Bets for Friday, January 9

January 8, 2026

College Basketball Picks Today: Expert college basketball handicapper Greg Peterson shares his top college basketball picks today for Friday, January 9. Check out Greg’s Daily College...

Pro College Basketball Picks for Thursday, January 8 from Adam Burke

January 8, 2026

College Basketball Bets Happy college hoops Thursday, as we have 57 games on the slate to think about. Just like last night, we have a...

Pro Men’s and Women’s College Basketball Best Bets, Odds, and Predictions for Thursday, January 8

January 8, 2026

Men’s and Women’s College Basketball Best Bets: Welcome back to the daily edition of men’s and women’s college basketball projections, courtesy of my proprietary ratings...

Pro College Basketball Picks Today: Greg Peterson Best Bets for Thursday, January 8

January 7, 2026

College Basketball Picks Today: Expert college basketball handicapper Greg Peterson shares his top college basketball picks today for Thursday, January 8. Check out Greg’s Daily College...

Pro Top Picks from the CBB Betting Splits for Wednesday January 7th

January 7, 2026

Today we have a loaded slate of College Basketball action on tap with 54 games to choose from. Let’s examine where smart money is leaning...

Pro College Basketball Picks for Wednesday, January 7 from Adam Burke

January 7, 2026

College Basketball Bets Last night’s college basketball slate was quality over quantity. Tonight’s college basketball slate presents us with both, as we have 54 games...

Pro Men’s and Women’s College Basketball Best Bets, Odds, and Predictions for Wednesday, January 7

January 7, 2026

Men’s and Women’s College Basketball Best Bets: Welcome back to the daily edition of men’s and women’s college basketball projections, courtesy of my proprietary ratings...

Pro College Basketball Picks Today: Greg Peterson Best Bets for Wednesday, January 7

January 6, 2026

College Basketball Picks Today: Expert college basketball handicapper Greg Peterson shares his top college basketball picks today for Wednesday, January 7. Check out Greg’s Daily College...

2026 College Basketball Futures Odds and Predictions

January 6, 2026

2026 College Basketball Futures Odds and Predictions: Now that college football is generating so much attention as it moves to its Final Four, let’s still...

Pro Top Picks from the CBB Betting Splits for Tuesday January 6th

January 6, 2026

Today we have a loaded slate of College Basketball action on tap with 29 games to choose from. Let’s examine where smart money is leaning...

Pro College Basketball Picks for Tuesday, January 6 from Adam Burke

January 6, 2026

College Basketball Bets A list of 29 college basketball games appears for Tuesday, but we have some real bangers. This is not a quantity slate,...

Pro Men’s and Women’s College Basketball Best Bets, Odds, and Predictions for Tuesday, January 6

January 6, 2026

Men’s and Women’s College Basketball Best Bets: Welcome back to the daily edition of men’s and women’s college basketball projections, courtesy of my proprietary ratings...